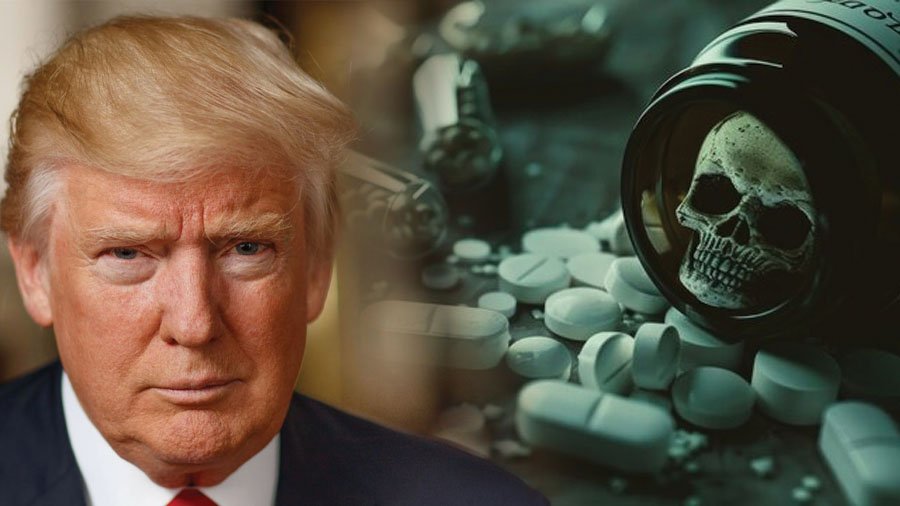

Donald Trump’s 100% tariff on branded drugs spares generics for now but rattles India’s $20 billion pharma export industry.

US President Donald Trump has announced a 100 per cent tariff on all imported branded and patented drugs, effective 1 October 2025. The move spares generics for now but has rattled global pharma and raised alarm bells in India, which depends heavily on the US market.

Trump’s Message

Making the announcement on social media, Trump declared: “Starting 1 October, we will impose a 100 per cent tariff on any branded or patented pharmaceutical product unless a company is building their manufacturing plant in America.” He added that only firms with plants “already breaking ground” in the US would be exempt.

Pharma Stocks Slide

The announcement hit Indian pharma stocks immediately. Sun Pharma plunged nearly 5% to a 52-week low before closing 2.6% lower. Biocon fell 2.56%, while Aurobindo Pharma slipped close to 1%. Market experts say the shock came from the “all at once” tariff move rather than a gradual rollout.

Immediate Impact vs Future Risks

While generics are officially excluded, experts warn the industry cannot breathe easy. “India, being an exporter of generics, is unlikely to be impacted by this… but perhaps the president’s next target can be generic drugs,” said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments.

India’s Reliance on the US

The US accounts for 35% of India’s pharma exports, worth nearly $10 billion in FY2025. Companies like Sun Pharma, Dr Reddy’s, Cipla, Lupin, and Aurobindo rely on American buyers for up to half their revenues. Even small policy shifts could devastate profit margins, which are already under pressure.

Calls for Trade Deals

Rahul Ahluwalia, Director at the Foundation for Economic Development, urged New Delhi to respond strategically. “India’s main exports are generics, so immediate impact should not be very high, but this is a troubling sign for future development. We should redouble efforts to get a trade deal with the US and EU to secure market access.”

Global Pharma’s US Rush

Multinationals like Pfizer, Roche, AstraZeneca, Merck and Biogen are already racing to expand manufacturing inside the US. Indian giants with US plants may be shielded, but analysts warn that building new facilities or acquiring existing ones could take 5–10 years, slowed further by FDA hurdles and labour shortages.

Complex Generics in the Grey Zone

Analysts are especially worried about complex generics and specialty medicines. While simple generics are safe, it is unclear whether advanced products — like injectables, inhalers, or slow-release drugs — could later be included in tariff lists. These categories are far costlier to produce and vital for revenue growth.

Biologics and Biosimilars at Risk

The future of biologics and biosimilars is also uncertain. Biologics, developed from living cells, are central to cutting-edge therapies. Biosimilars are their near-equivalents and have opened up cheaper treatment options worldwide. If tariffs extend here, Indian firms could face a major financial blow.

Industry Voices

Pharmexcil Chairman Namit Joshi sought to calm fears, saying: “The proposed tariff is unlikely to have an immediate impact on Indian exports, as most of our contribution lies in simple generics. Many large Indian companies already have US manufacturing or repackaging units.”

Sun Pharma’s Exposure

Sun Pharma faces direct exposure due to Ilumya, its branded psoriasis drug made outside the US. Analysts warn tariffs could double costs, though as a chronic therapy drug, Sun may be able to pass on some of the cost to patients.

The Big Picture

Pankaj Pandey of ICICI Securities summed up the sentiment: “Near-term impact is limited as India mainly exports generics. But uncertainty remains over whether complex generics and biosimilars will come under tariffs in the future.”